This section provides definitions for key terms contained within this report. To find out more about our new complaint process and related terminology, see Who we are and what we do.

Accepted complaint

An accepted complaint is a complaint by a customer that falls within our mandate.

Alleged breach

An alleged breach is one of 2 things:

- a claim by a customer that a service provider has breached a particular section of a CRTC code

- a possible breach of a CRTC code that we identified when we assessed the customer’s complaint.

A breach remains an alleged breach until we confirm it through investigation. There may be more than one alleged breach in a complaint.

A breach happens when a service provider fails to follow one of 4 codes of conduct issued by the CRTC:

- Deposit and Disconnection Code

- Internet Code

- Television Service Provider Code

- Wireless Code

Assessment

During an assessment, we check the information the customer gave us to find out if we can accept their complaint.

Case Review

A Case Review can be requested by the customer or the service provider. They do this if:

- They think we made an error of fact or interpretation.

and

- They think our error affected the Investigation Findings.

If it seems more likely than not that we made such an error, we conduct a Case Review. Then, we issue confirmed or amended Investigation Findings.

We began conducting Case Reviews on May 23, 2023.

Closed complaint

A closed complaint is a complaint that we originally accepted but closed for one of several reasons. The following are 3 examples of reasons for closing complaints

- We issued Investigation Findings for the complaint.

- The customer should have taken their complaint to another agency, tribunal, or court.

- After filing the complaint, the customer either withdrew it, failed to cooperate with our processes, or failed to answer our communications.

Until May 23, 2023, we closed complaints where we found that the complaint was without merit, or the service provider offered to resolve the complaint with the customer and we found the solution to be fair and reasonable under the circumstances. As of May 23, 2023, we issue Investigation Findings in all these situations.

Conciliation

The CCTS works with the customer and the service provider to informally mediate and explore possible solutions to resolve the complaint, without going to the time and expense of conducting a full investigation that may be unnecessary.

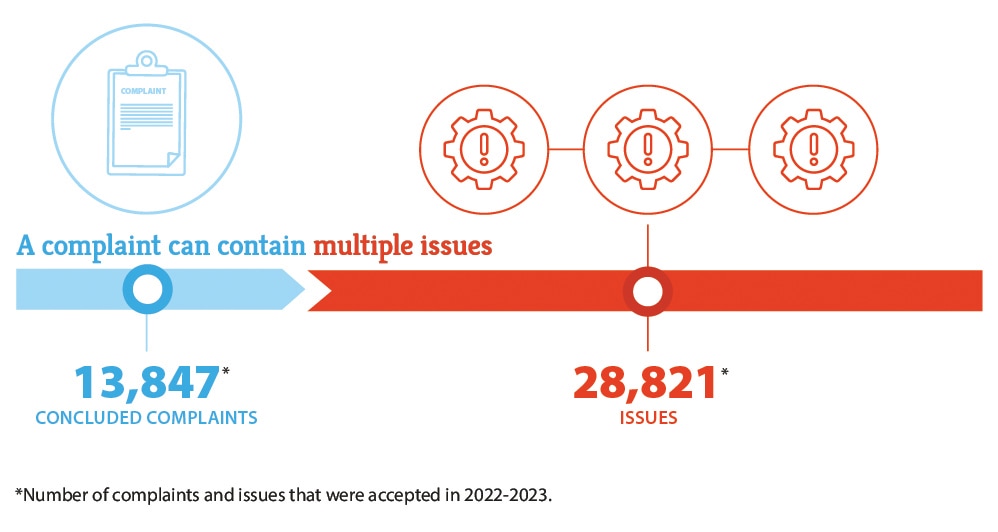

Concluded complaint

A concluded complaint is one that we accepted and resolved or closed. We accepted some complaints during the previous fiscal year that we concluded during this reporting period.

Confirmed breach

A confirmed breach is an alleged breach of a CRTC code that we confirmed through our investigation.

Customer not cooperative

A customer is not cooperative when they fail to do these things:

- respond to our attempts to communicate with them

- communicate with the service provider during the Pre-Investigation or Initial Referral stage of our process.

In this situation, following multiple attempts to elicit customer cooperation, we will close the complaint.

Decision

Until May 23, 2023, the Commissioner of the CCTS issued Decisions following this process:

- A customer or service provider rejected our Recommendation.

- The customer or service provider who rejected the Recommendation sent us their reasons for doing so.

- The Commissioner reconsidered the Recommendation.

- The Commissioner issued a Decision, which would either confirm the original Recommendation or change the Recommendation if they found it to be incorrect.

Service providers had to abide by the Decisions; customers did not. We no longer issue Decisions.

Further investigation not warranted

We used the term further investigation not warranted until May 23, 2023. It meant that we closed the complaint if we found that the service provider had reasonably performed its obligations to the customer.

As of May 2023, we issue Investigation Findings when a complaint cannot be resolved informally. We do this whether or not we find that a provider has met its obligations to the customer.

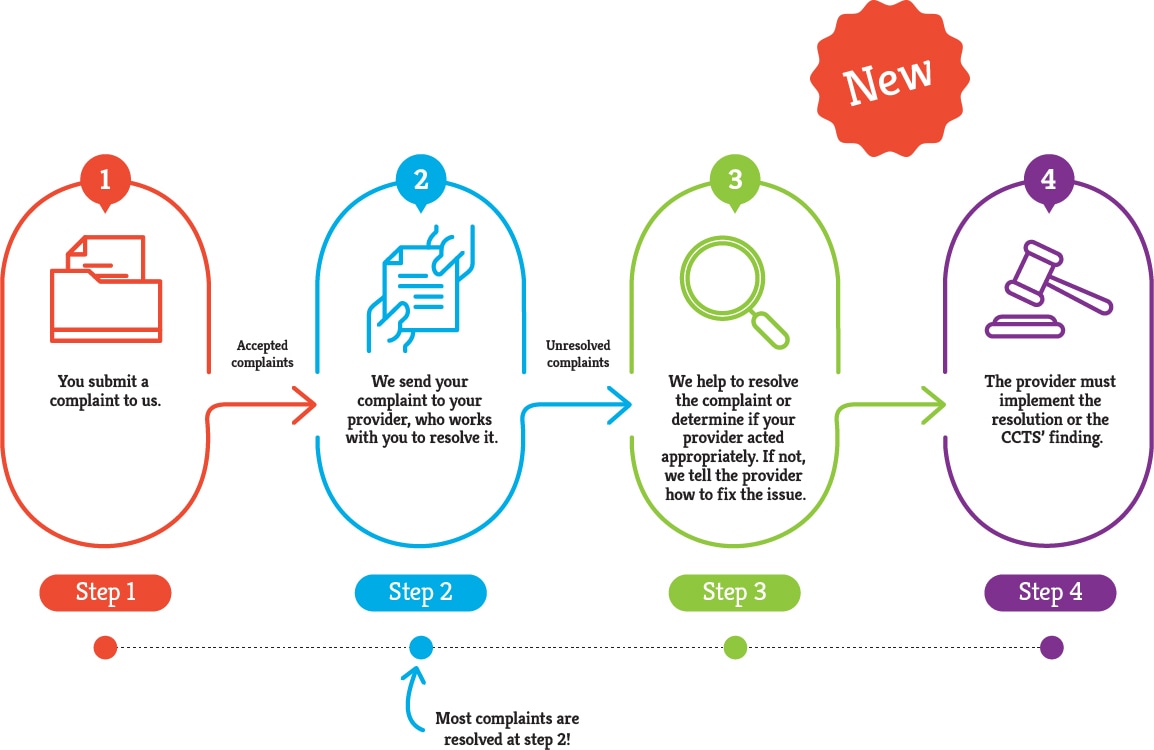

Initial Referral

This Initial Referral happens after we accept a complaint. We refer the complaint to the service provider to provide another opportunity to try to resolve it with the customer. The customer and the service provider have 20 days to resolve the issue. If they don’t resolve it, it goes on to the next stage of the process.

Investigation

During the investigation, we analyze and assess the information and documents the customer and the service provider give to us. We want to know if the service provider acted appropriately, and reasonably met its obligations to the customer. Since May 23, 2023, we issue Investigation Findings that explain if the provider met their obligations.

Investigation Findings

Investigation Findings are a written report of the result of our analysis and assessment of the complaint. We base our Findings on the information and documents the customer and the service provider give to us. These Findings explain whether the service provider met their obligations to the customer. If they did not meet their obligations, the Findings explain what the provider must do to correct the issue. If the provider and the customer both accept the Findings, the provider must make the stated corrections. We then close the complaint. We have been issuing Investigation Findings since May 23, 2023.

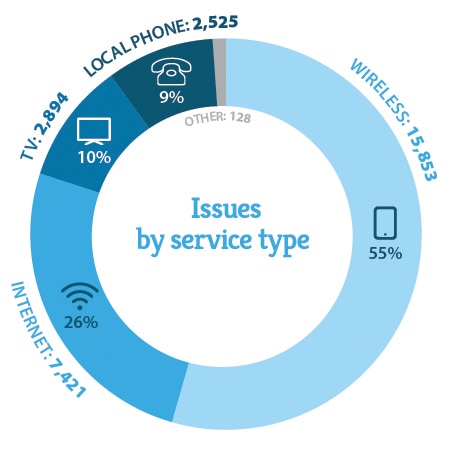

Issue

An issue is a specific concern a customer raises in a complaint. A complaint can contain more than one issue. For example, a customer complains that their invoice contains a billing error and that the unpaid balance resulted in a service disconnection. This is one complaint with two separate issues.

No breach

We conclude that there is no breach after we have investigated an alleged breach and found that the service provider did not breach a CRTC code provision.

Out of mandate

Certain complaints fall outside our mandate. These include complaints about privacy, telemarketing calls, and advertising. As they are out-of-mandate, we cannot accept them.

Pre-Investigation (replaced by Initial Referral)

Until May 23, 2023, Pre-Investigation was the first stage of our complaint-handling process. We referred the complaint to the service provider so they could try to resolve the complaint. The customer and the service provider had 30 days to resolve the issue. If they did not resolve it, it went on to the next stage. Since May 23, 2023, this stage is now called Initial Referral.

Recommendation

Until May 23, 2023, we issued a Recommendation after we investigated a complaint and the service provider did not offer to resolve the complaint, or the service provider offered a solution that we did not find to be reasonable based on the circumstances of the complaint.

We made Recommendations that told the provider what actions to take to resolve the matter. Since May 23, 2023, we no longer issue Recommendations. We now issue Investigation Findings.

Resolved

A complaint is resolved when both the customer and the service provider agree to the solution.

Service provider offer is reasonable

A service provider’s offer is reasonable when it makes an offer to resolve a complaint and we determine that the offer resolves the problem fairly based on the circumstances of the complaint. In this situation, we would close the complaint even if the customer does not agree that the offer is reasonable.

Since May 23, 2023, we no longer close complaints if we find that the service provider’s offer is reasonable. Now, we issue written Investigation Findings when the customer and service provider fail to resolve the complaint informally. This increases the transparency of our complaint-handling process and our decision-making rationale.

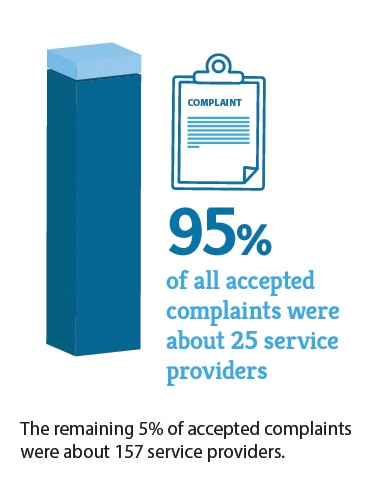

Together, the top 25 PSPs accounted for 95% of all accepted complaints in 2022-23. The remaining 5% of accepted complaints, 753 complaints, are about 157 service providers.

Together, the top 25 PSPs accounted for 95% of all accepted complaints in 2022-23. The remaining 5% of accepted complaints, 753 complaints, are about 157 service providers.