PSPs must follow the rules when objecting to complaints

The CCTS Procedural Code allows the CCTS to accept telecom and television-related complaints, with certain exceptions. PSPs have the right to object to the CCTS accepting a complaint if they believe it falls within one of these exceptions. A recent change to the rules now requires PSPs to file objections within 10 days of being informed that the CCTS has accepted the complaint, instead of the previous 15-day timeframe.

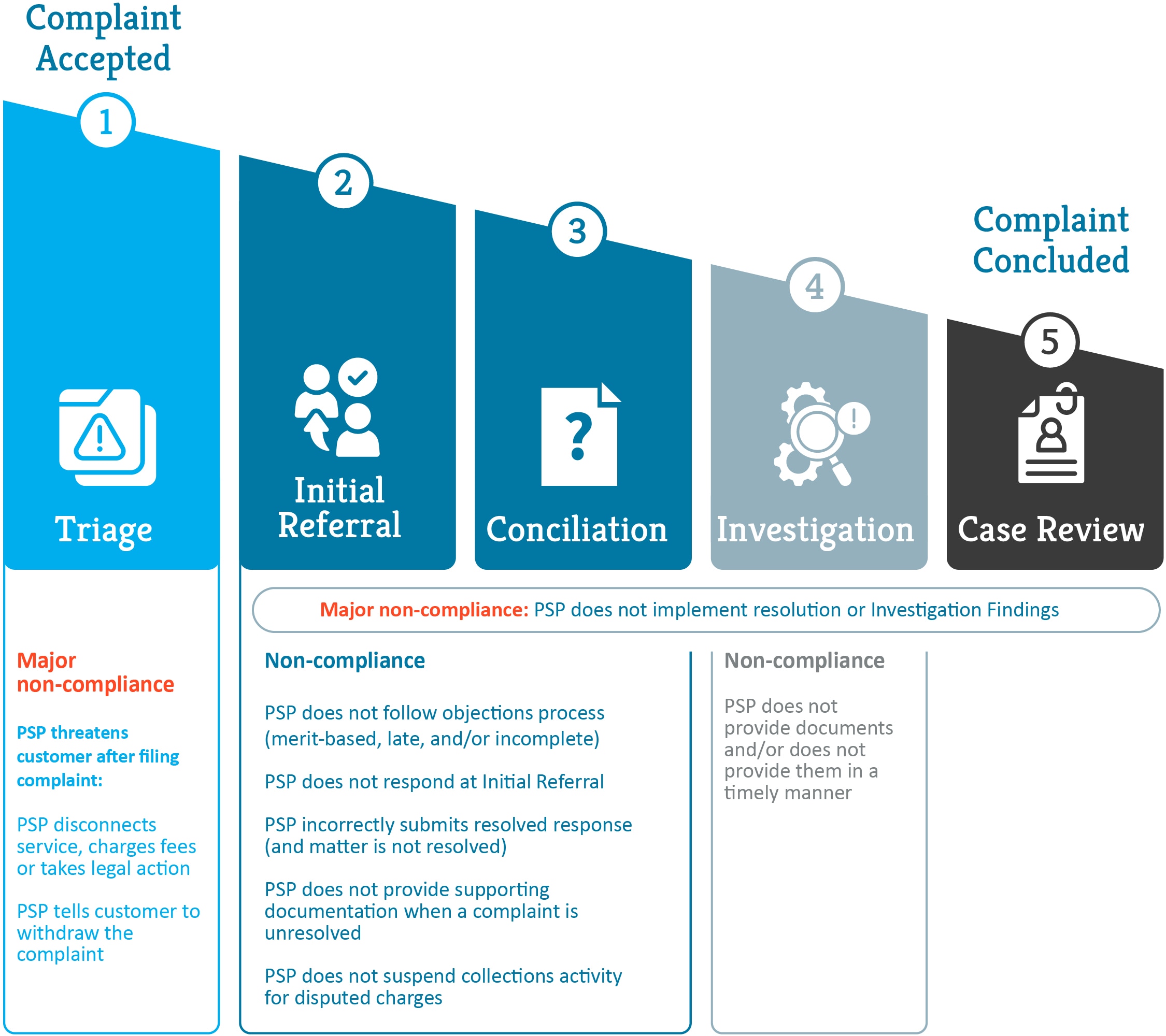

When filing an objection, PSPs must clearly state the reason and provide supporting documentation for the CCTS to evaluate its validity. If a PSP objects to a complaint but fails to follow the required procedure, it is considered a breach of the Procedural Code. Common objection-related breaches include submitting an objection late, failing to provide an explanation or supporting evidence, or objecting on an improper basis, such as disputing the merit of the customer’s complaint rather than its eligibility under the rules.

Non-compliance with objection rules causes unnecessary delays in the complaint process and hinders the effectiveness of the CCTS. Each year, we track objection-related breaches, and we will continue monitoring PSP misuse of the objections process.