Footnotes

- Statement by the CRTC’s Vice-President of Consumer, Analytics and Strategy, Scott Hutton, on recent actions to protect Canadians, 5 November 2024, https://www.canada.ca/en/radio-television-telecommunications/news/2024/11/statement-by-the-crtcs-vice-president-of-consumer-analytics-and-strategy-scott-hutton-on-recent-actions-to-protect-canadians.html.

- Public Opinion Research Report: “Understanding consumer awareness and satisfaction with the Commission for Complaints for Telecom-television Services (CCTS).” April, 2024. See “E. Key Findings” section: https://epe.bac-lac.gc.ca/100/200/301/pwgsc-tpsgc/por-ef/crtc/2024/080-23-e/080-23-report.html#a1.5.

- Broadcasting and Telecom – Secretary General Letter – ref CR104 – Reminder to Service Providers to make customers aware of the CCTS, November 5, 2024, https://crtc.gc.ca/eng/archive/2024/lb241105.htm?_ga=2.91287896.339985199.1736779617-1724186827.1713371788.

- CCTS 2023-24 Annual Report, “Working with customers: Listening to customers – What customers said about service provider public awareness activities” https://pub.ccts-cprst.ca/2023-2024-annual-report/working-with-customers/.

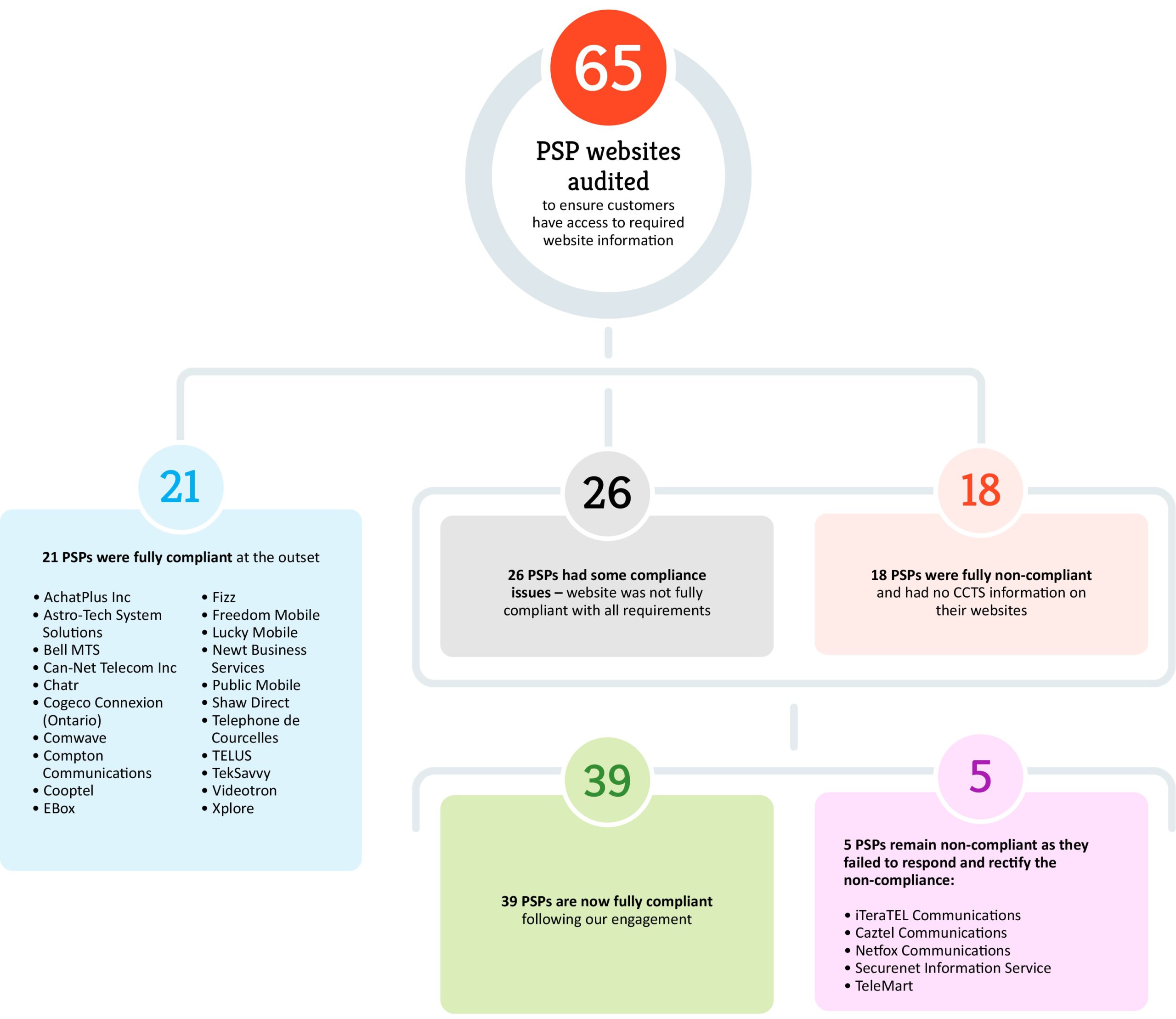

- There were two rounds of Public Awareness Plan audits in January 2024 and September 2024.

- The audit conducted in January 2024 consisted of 19 randomly selected PSPs that CCTS had not previously audited and 2 PSPs previously identified as non-compliant.

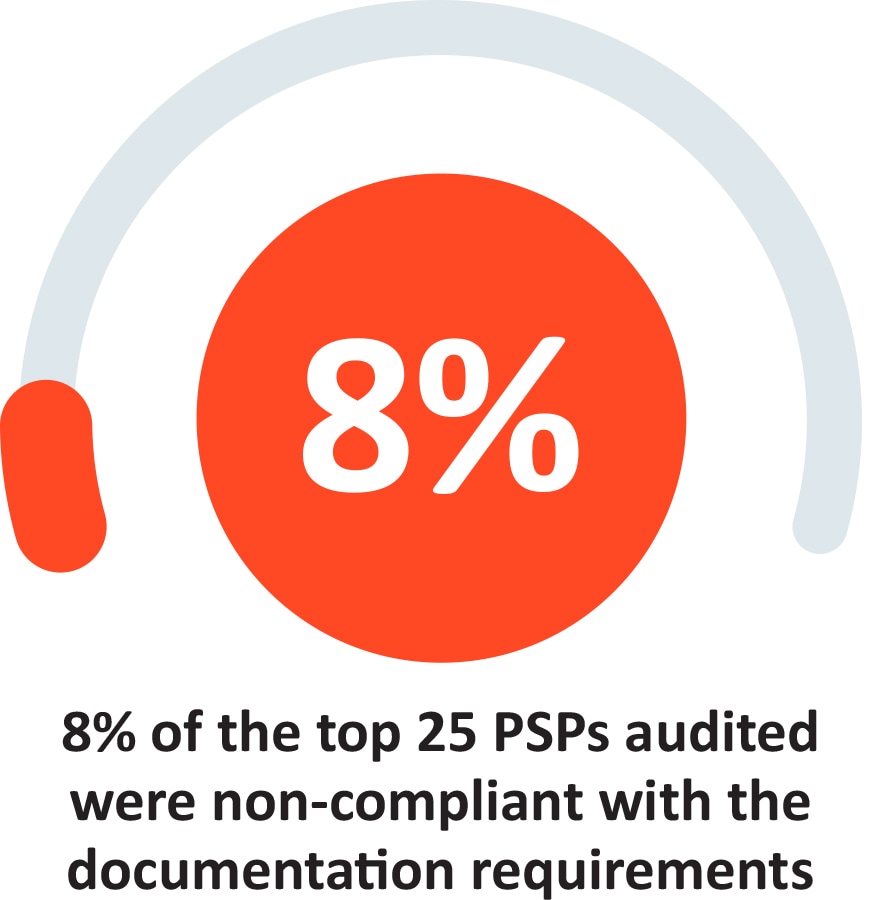

- In September 2024, we audited 44 PSPs which included the 25 PSPs that generated the most CCTS complaints in the previous year, as listed in the 2022-2023 Annual Report, 18 randomly selected PSPs (previously unaudited), and 1 PSP previously identified as non-compliant. This category ensures that all PSPs, regardless of their size and compliance status, can be reviewed from time to time to determine their compliance with the Public Awareness Plan requirements. Including this year, the CCTS has audited the websites of 249 PSP brands since 2018.

- iTeraTEL Communications Inc. did not update its website.

- Public Opinion Research Report: “Understanding consumer awareness and satisfaction with the Commission for Complaints for Telecom-television Services (CCTS).” April 2024. See “E. Key Findings” section: https://epe.bac-lac.gc.ca/100/200/301/pwgsc-tpsgc/por-ef/crtc/2024/080-23-e/080-23-report.html#a1.5.

- CCTS 2023-24 Annual Report, “Working with customers: Listening to customers – What customers said about service provider public awareness activities” https://pub.ccts-cprst.ca/2023-2024-annual-report/working-with-customers/.

- Broadcasting and Telecom – Secretary General Letter – ref CR104 – Reminder to Service Providers to make customers aware of the CCTS, November 5, 2024. https://crtc.gc.ca/eng/archive/2024/lb241105.htm?_ga=2.91287896.339985199.1736779617-1724186827.1713371788.

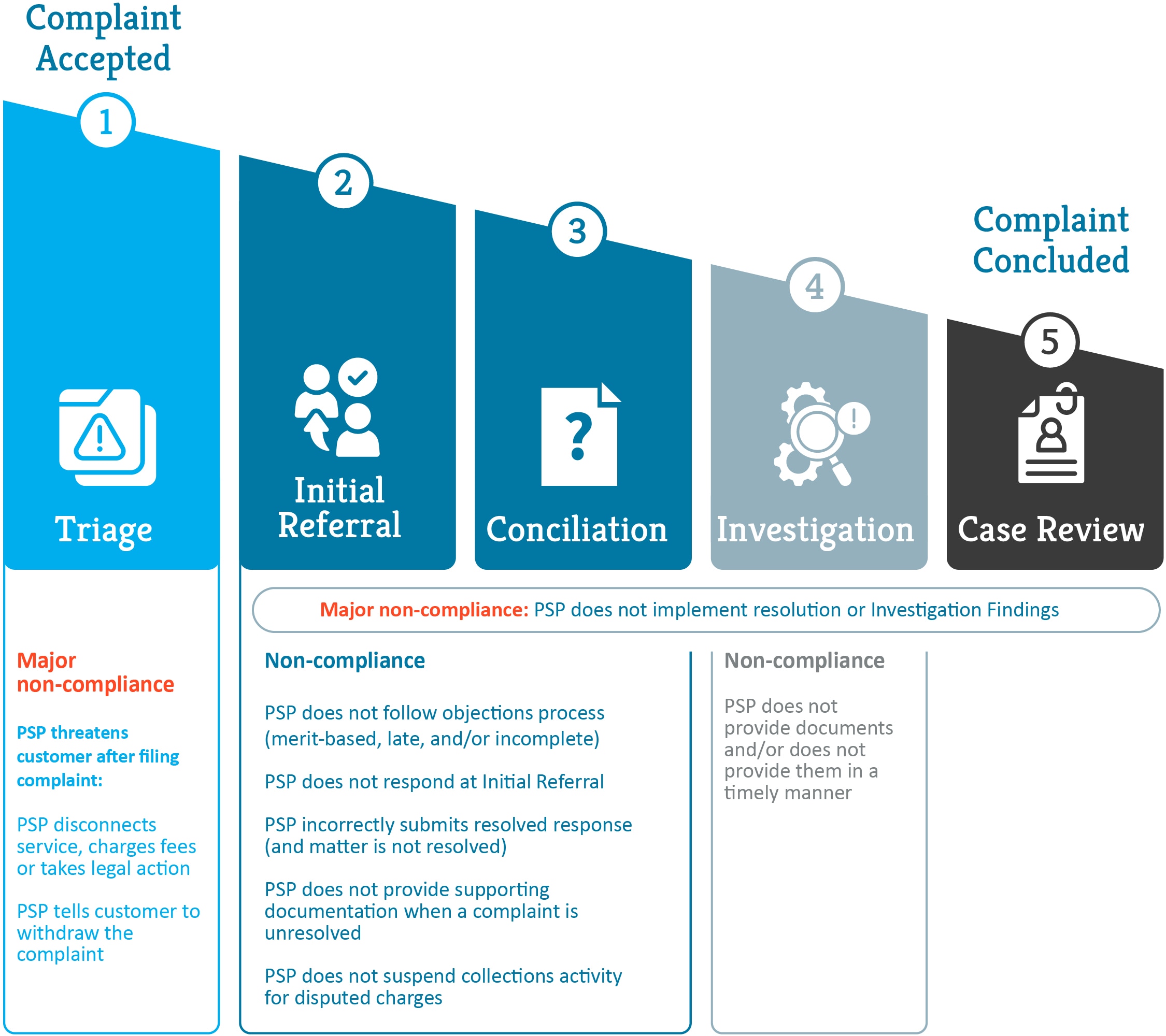

- Mutually acceptable resolutions are agreements between the PSP and the customer on a specific outcome or actions to be carried out to resolve a complaint filed with the CCTS.

- The CCTS issues Investigation Findings after a complaint is fully investigated. Investigation Findings are a written report of the result of our analysis and assessment of the complaint. We base our Findings on the information and documents the customer and the service provider provide to us. These Findings explain whether the service provider met their obligations to the customer. If they did not meet their obligations, the Findings explain what the provider must do to correct the issue – and the provider is required to implement these actions.

- Three complaints with Rogers, two complaints with Bell Canada, one complaint with Tiny Mobile, one complaint with TELUS, one complaint with Shaw and one complaint with DigiCom Internet.

- Bell Canada