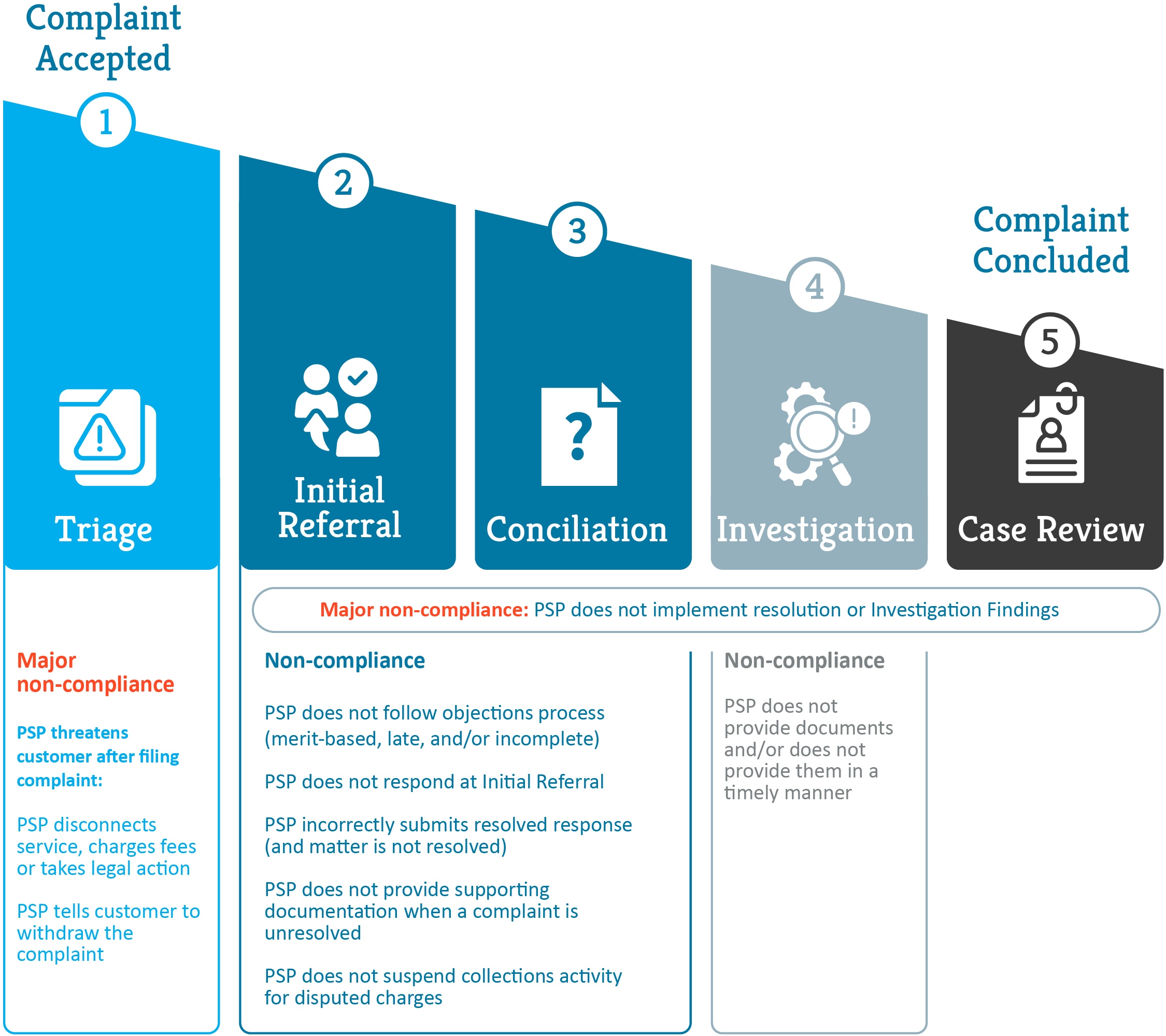

PSPs must not ask customers to withdraw their complaint at the CCTS

When a PSP engages in this behaviour, the PSP is not participating in good faith as it is trying to circumvent the requirement to respond to complaints. If the customer and PSP agree to resolve a complaint, the PSP must advise the CCTS that the complaint is resolved. If the PSP tells the customer to withdraw that complaint, then the customer will not be able to follow up and request the CCTS to ensure the resolution is implemented because the complaint was withdrawn from our process (i.e. not resolved within our process). The CCTS informs the customer that if a complaint is withdrawn, then the CCTS will likely be unable to help ensure that the PSP implements the resolution it promised the customer as the enticement for withdrawing the complaint.

In 2023, the CCTS confirmed in 1 complaint that a PSP disconnected the customer because of their CCTS complaint. The PSP sent the customer a notice of service disconnection after the customer filed a complaint. The Compliance team educated the PSP that it should not engage in this type of behaviour. The PSP explained to us it did not know it wasn’t allowed to do this and that it never intended to punish the customer for filing a CCTS complaint and it would not do this again in the future.

Another newly signed-up PSP asked their customer to withdraw the complaint at the CCTS. The Compliance team engaged the PSP who informed us they did not know how to use the CCTS process and that it was not supposed to ask the customer to withdraw the complaint. We informed the PSP of what they should do, and they understood not to engage in this behaviour moving forward.

Often, when we engage PSPs and explain the rules around the complaints process, the PSP is cooperative and complies quickly. We appreciate working with PSPs who want to do the right thing and do what we can to help PSPs better understand the CCTS complaint process.